What to do if you’re itching to start a business, but that perfect idea just doesn’t come to mind? Luckily for you, we have an answer (or rather ...

The IRS website is a good place to start, or you may wish to consult a local tax accountant.

We earn commissions if you shop through the links below. Read more

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on October 27, 2021

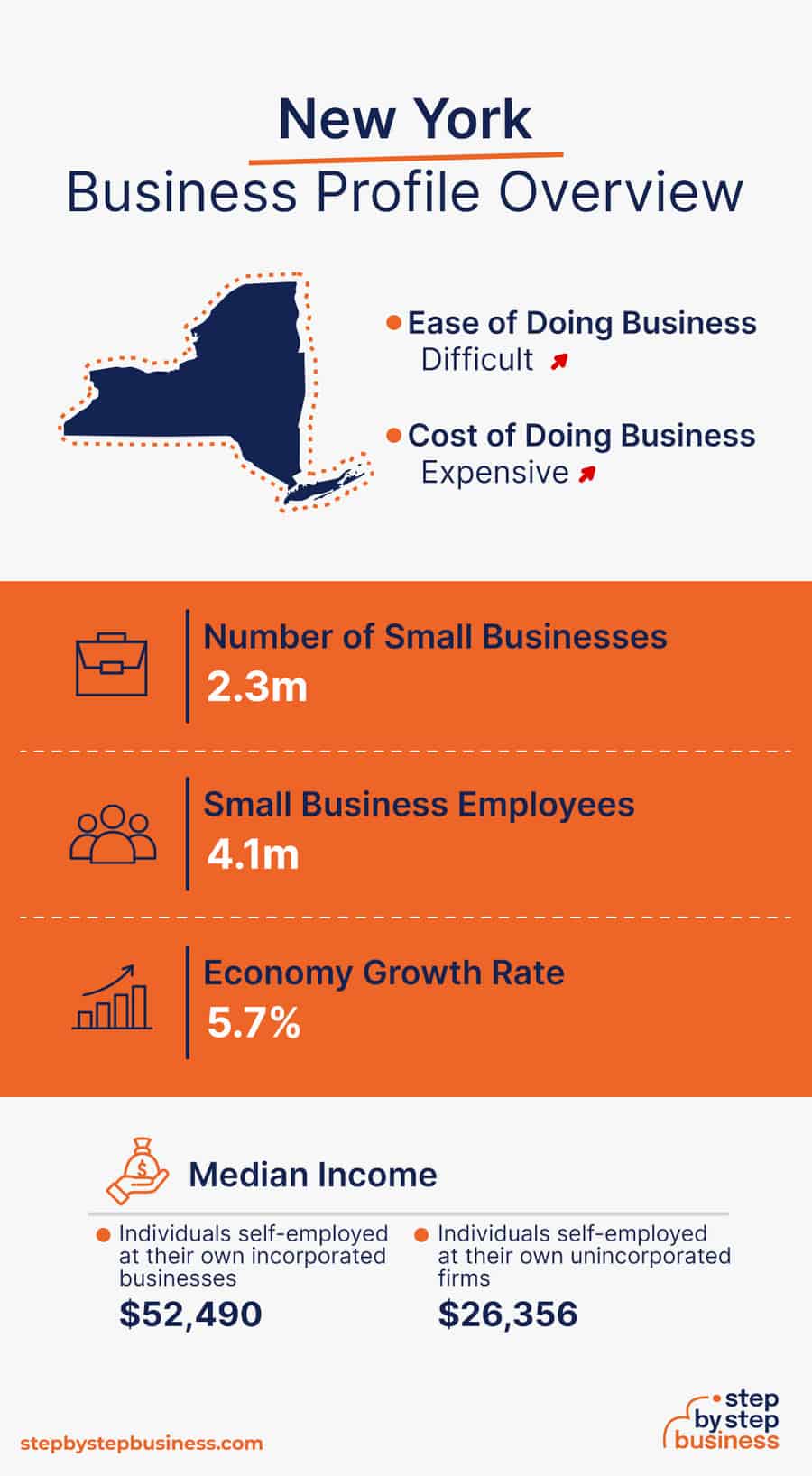

If you live in New York, you are in one of the world’s great business capitals. Many top investors and multinationals make their home in New York City or elsewhere in the state. You may have your own business idea, or maybe you just imagine running your own business in The Big Apple, the largest city in the United States by population.

Either way, getting your business off the ground will require a great deal of work. The key is gaining as much knowledge as possible and patiently moving through the development and launch process for a New York business, as outlined in our step-by-step guide below.

By 2022 revenue((https://www.ibisworld.com/united-states/economic-profiles/new-york/))

Choosing a business idea is of course the first step. You may have several ideas in mind that you can choose from, or you may not have gotten that far yet.

If you’re starting from scratch, there are a few ways to approach coming up with a business idea. You can:

Once you have a few ideas in mind, it’s a good idea to do some homework before settling on a decision. Here are some things to consider when choosing a business idea:

Once you have chosen a business idea, get more specific in your evaluation of the opportunity. Consider the why, what, how, and who.

Consider if you have really identified an opportunity in the market. Is your idea going to provide value to customers? Will people want to buy it?

You can’t make assumptions about the viability of your idea. Research it and ask people you know what they think of your idea.

Look at companies that offer the same or similar products or services. Research what they are selling, their prices, and their sales totals. Is there real opportunity here?

The next thing to do is define your offerings. Ask yourself:

If you’re selling one product, you may consider offering related products or services to increase the value you provide.

This step is going to define what your business will look like to customers and why they will buy, so take your time and be sure.

Before deciding on your price list, you should benchmark your competitors: look for similar products and check their pricing.

If you have a direct competitor that offers similar products or services, it’s a good idea to select a competitive price point. You can do this by running the numbers to determine your break-even price, then decide your profit-generating mark-up from there.

You’ll also need to consider how to position your product. Are you going to offer a lower-priced alternative, a la Walmart, or are you going to position your product as a more expensive high-end item?

Once you’ve locked on a pricing system that works for you, you’ll need to test it to see if this is attractive to your target market.

Knowing your target market is crucial to successful sales and marketing. This is where customer profiling comes in handy.

The first thing to do is to figure out whether you are selling to consumers (B2C) or businesses (B2B). If you are selling to consumers, determine what type of people are most likely to buy, by looking at:

Knowing your customers will allow you to shape your messaging, and to know where to place your marketing. For example, based on who your customers are and what they like, are they more likely to be on Facebook or TikTok?

If you are selling to businesses, you need to determine what kinds of companies need what you’re offering. Then you need to determine who within those companies will be the decision-maker. Will it be an IT manager? Sales manager? Then, adjust your marketing accordingly.

Your company’s business name is often the first impression clients have of your brand. Do your best to make it unique and appealing.

You probably want a name that is short and easy to remember, since much of your business, and your initial business in particular, will come from word-of-mouth referrals.

Here are some suggestions for brainstorming your business name:

Once you’ve got a list of potential names, check the New York state website to see if the name is available to register in your state and check the availability of related domain names using Domain Name Checker tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these. If you plan to do business in other parts of the country, consider trademarking the name at the website of the US Patent and Trademark Office.

You should also check that the name you want to register conforms to New York’s LLC and Corporate naming rules. Once you’re sure that the name is all yours and meets the regulations, go ahead and register the name with your state. Here is the official New York website that provides their Name Reservation Request form. The completed application can be sent by mail or dropped off in person, together with the statutory filing fee of $20, at the following address: NYS Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231

Drawing up a business plan may seem a daunting task, but it is an essential step in creating a successful business.

Every business needs a plan, a rough outline that helps guide a startup through the launch process while maintaining focus on key goals. A business plan is also crucial for helping potential partners and investors understand your company and vision:

Before you start selling you will need to ensure that your business is correctly registered with the relevant authorities. Get this right at the start and your business will run more smoothly and easily as you progress.

Your location and business structure will determine how your business should be registered, which varies from state to state. For most small businesses, the process is quick, easy, and cheap, requiring only that the business name be recorded with state and local governments.

Other than filing for a federal tax ID, most businesses do not need to register with the federal government to become a legal entity.

The legal structure you choose for your business will impact your business registration requirements, how much you pay in taxes, and your personal liability.

The most popular types of business entities are outlined below.

Sole proprietorship is the most simple and straightforward structure, and therefore the most common for small businesses. It is an unincorporated business, with no legal distinction made between the business and the owner. This means that as a sole proprietor you get to keep all the profits, but are also personally liable for any debts, losses, or liabilities.

A general partnership is similar to sole proprietorship, but in this case two or more people form the company. Again, they keep the profits but are jointly liable for any losses or liabilities. In a general partnership, each partner is known as a general partner and has unlimited liability.

This business structure is popular with lawyers, accountants, and architects. It is more formal than a general partnership and allows each limited partner to limit their liabilities and share management responsibilities according to an agreement between the partners. This can be a good choice when one or more partners wants to invest in the business but have little or no management responsibility.

In New York, you can only form an LLP if you are a licensed professional and are licensed to perform your services independently.

Here are some resources:

There is a $200 filing fee to register an LLP with the New York Department of State.

The next step up is a corporation, in which the company is a separate legal entity from its owners. In this structure, the owners are not personally liable for losses, but take their profits through shareholder dividends.

If you choose to create a New York corporation, you will also need to decide whether you want to form a C corporation or an S corporation.

Here are some resources:

There is a $125 filing fee to file your Articles of Incorporation with the New York Department of State.

A limited liability company (LLC) combines the characteristics of corporations with those of sole proprietorships or partnerships. As the name suggests, the owners are not personally responsible for liabilities or debts.

Although LLCs are more straightforward to set up than a corporation, Articles of Organization must be filed with the state for the LLC to become a legal entity.

Here are some resources:

There is a $200 filing fee to file your Articles of Organization with the New York Department of State.

You will also need to appoint a New York registered agent. Your New York registered agent will be responsible for receiving all of the official paperwork sent from the New York Department of State.

An easy and quick way to form an LLC in New York is to use ZenBusiness’s online LLC formation service.

Finally, you may be interested in a nonprofit if your business idea has a social purpose. A non-profit organization is a legal entity organized and operated for a public or social benefit, as opposed to a business formed to generate a profit for its owners.

Here are some resources:

There is a base fee of $75 for filing Articles of Incorporation for a nonprofit in New York.

Taxes are inevitable, so you’ll want to get prepared for tax season. Do this by applying for a New York Employer Identification Number (EIN), which is like a social security number for your business. (If you choose sole proprietorship, you can use your social security number as your EIN.)

You’ll use your EIN for important steps to start and grow your business, like opening a bank account. You’ll also need it to pay taxes, hire employees, and register an LLC or corporation.

The process is quick and simple. Just head over to the IRS website and fill out their online form to obtain your number. Once you’re registered, make sure you understand your tax liabilities by researching which taxes apply to your new business.

The IRS website is a good place to start, or you may wish to consult a local tax accountant.

You can visit the official site for the New York Department of Taxation and Finance to learn the necessary tax filings for businesses in the state. Some major taxes include:

There is also an annual fee for partnerships, LLCs, and LLPs registered in New York, based on their gross income in the preceding year. The minimum fee is $25 and can range into the thousands of dollars for businesses with an annual income of more than $1 million.

Securing financing is your next step, and it’s a crucial one for a new business. There are plenty of ways to raise capital:

You may need to obtain certain business licenses and permits to comply with New York law. These permits and licenses can vary based on the town or city where the business is located. If you sell or lease goods outside of a store in New York, you will need to obtain a General Vendor License. Additionally, as a seller, you may also need to register for New York sales tax.

Here are some further resources:

Before you start selling, you’ll want to open a business banking account. Keeping your business’s financial transactions separate from your personal finances will enable you to more effectively manage the money side of your business, including filing your taxes and dealing with your accountant when the time comes.

It will also be useful to get a business credit card to make purchasing goods and services easier. Banks offer a wide range of business accounts nowadays, so be sure to talk to your local branch to find the account that works best for you and your new business.

Your business will likely require significant investment, and it makes sense to protect that investment with business insurance. Here are a few options you may wish to consider:

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

New businesses need to have the right tools and industry-specific software in place to help them manage their operations effectively.

One of the most important tools for a new business is an inventory management system, which allows them to track their inventory levels, monitor sales, and reorder products when necessary.

Another essential tool is a customer relationship management (CRM) system, which helps businesses manage their interactions with customers and prospects, and track sales leads.

Other useful software for new businesses might include payroll software, project management tools, and marketing automation software. By investing in the right tools and software, new businesses can streamline their operations, save time and money, and ultimately increase their chances of success.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Online marketing is crucial for new businesses as it provides a cost-effective way to reach a wider audience and build brand awareness. With a well-planned online marketing strategy, new businesses can establish their presence, attract potential customers, and compete with established players in their industry.

Here are some powerful digital marketing strategies for small businesses:

Take advantage of your website, social media presence and real-life activities to increase awareness of your offerings and build your brand.

Traditional marketing is any form of marketing that uses offline media to reach an audience. Some options include:

You will probably need employees to help you run your business. First, you will need to determine what roles will be essential. This will come down to which essential functions you can’t do or won’t have time to do.

Then you need to determine how the team will be structured. What levels of management and employees will you have? Then you need to determine what your pay structure and ranges will be.

When you’re just starting, cash may be an issue but you need to make sure that you pay enough to get people with the right skills and experience.

Finally, create a hiring plan. Determine who you need to hire first in order to launch, and then plan what future hires you will need to make as the business gets going. Be cautious and selective when hiring people for any role.

You want to build a great team that will make your business run smoothly, and then create a great work environment so that you’ll retain your team for a long time.

The official New York tax site features a guide on what you may need to do as your hire employees. It also features a New Hire Online Reporting Center where you can learn how to report new hires to the state.

With everything in place, you’re now ready to throw open the doors on opening day! When you do, you’ll want some customers coming in. Here’s how to find them.

What is unique about your product or service? Your potential clients likely already know why they want your services, your job is now to convince them to pick you over a competitor.

Here are some potential selling points to help you stand out from the crowd:

Make sure you’re selling through the right channels. You know your target customers by now – where and how are they most likely to buy? What are their preferred prices?

If you don’t have a store, you can find partner stores where your products can be sold.

You can sell both online and directly but focus your efforts on the channel that matches your target market’s buying behavior.

If you’re selling to businesses, your sales channels may be online or they may involve direct sales calls. Again, understand the buying behavior of the decision-maker within the business.

Help clients find you more easily by placing your marketing where they are likely to find it. With the right marketing strategies in place, a business can reach new audiences, build brand awareness, and ultimately grow its customer base and revenue.

Effective marketing can help businesses differentiate themselves from competitors, establish a strong online presence, and engage with customers through various channels such as social media, email marketing, and advertising.

By investing in the right marketing tactics and continually analyzing and optimizing their efforts, businesses can position themselves for long-term growth and success.

Fees to register your business vary by type of entity and location in New York. For a business certificate, corporations, limited partnerships, and LLCs pay a filing fee of $25 with the state. Additionally, county fees will apply, ranging from $100 for any county in New York City and $25 for any other county in the state.

For a certificate of incorporation, the filing fee is $125 + $10 + authorized share tax. For a certificate of limited partnership, the filing fee is $200 + $50 for Certificate of Publication. And for an LLC’s Articles of Organization the filing fee is $200 + $50 for Certificate of Publication.

The time to process your corporation or LLC formation will vary but should take more than 4-6 weeks. For many forms and certifications you can pay around $50-$100 for expedited processing.

Published on August 7, 2024

What to do if you’re itching to start a business, but that perfect idea just doesn’t come to mind? Luckily for you, we have an answer (or rather ...

Read Now

Published on June 6, 2024

You’ve got a brilliant business idea, a solid execution plan, and an unbeatable drive. But wait! There’s one thing missing in yourentrep ...

Read Now

Published on October 30, 2023

Surprisingly, 50% of small businesses encounter financial hurdles in their first five years. Finding the right loan can be a lifeline, steering your ...

Read Now

Published on September 29, 2023

Ensuring that your business is protected against unforeseen events is crucial, and this is where choosing the right insurance provider becomesindisp ...

Read Now

Published on February 19, 2023

New business owners usually need to complete countless tasks before finally launching and doing business. One of the earliest and most importanthurd ...

Read Now

Published on August 12, 2022

From selling on Poshmark to operating an online gambling casino, the list of online businesses is endless. The pandemic has caused manyentrepreneurs ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments